🚀 Every great journey starts with a single step—let this blog be your guide to unlocking new ideas, opportunities, and success 💡. Dive in and transform your life today 🔥💯

You can also get rid of them by not paying the ongoing loan quickly. I’ll tell you here! Eight simple ways by which you can Save Big Money & millions of rupees by paying your loan quickly.

First, Prioritize High-Interest Loans

First, know what loan is currently costing you more. If one of the many loans you’ve acquired is now at a more expensive interest, you must then prioritize paying the highest-interest-bearing loan first—the one that gets paid off using either prepay or foreclosure, and that alone. That reduces your interest charges the fastest directly, thereby relieving your payment on your principle amount the quicker. The earlier you clear any high-interest obligation, the freer you would be!

Pay a Bigger Down Payment

When getting a loan, do not pay the minimum down payment. If you can afford it, increase your down payment. A bigger down payment reduces the amount of money you borrow. This means less interest paid on the loan and you will be able to pay off the loan faster. More money upfront could mean freedom from debt sooner, and with consistent income, you will pay it off faster.

- AI Fraud Detection: 7 Cutting-Edge Strategies to Stop Scams Fast

- 10 Essential Steps to Protect Yourself From Identity Theft in 2025

Pick Loans with Low Interest Rates

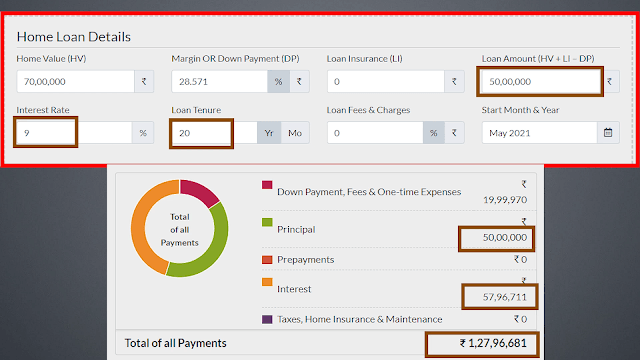

While making a loan decision, always look for the lowest interest rates possible. A 1% interest rate difference will save you much money in the long run. For instance, if you’re taking a home loan, it can save you thousands of dollars if the interest rate is lowered by 1%. The amount you pay becomes less with the lower interest rate, and it saves you more money and makes you repay your loan faster.

Pay Pre-Emptive

This is one of the fastest ways to reduce your loan balance. Each year, make an extra payment towards your loan. In doing so, you will pay less on the principal amount, and the interest on your loan will also decrease. For example, paying ₹1,00,000 annually will save you a huge amount of interest and will also reduce the tenure of your loan.

Shorten Your Loan Tenure To Save Big Money

If you can afford bigger EMI payments, then you should shorten the tenure of your loan. This will definitely be a bit of an increase on the EMI but will allow you to close the loan in as short a time as possible, saving you thousands of dollars in interest. Not only will your loan get cleared faster but the financial relief will be huge. How to Make Money by Uploading Movies Fast on YouTube

Never Miss an EMI

Always make sure to never miss any monthly EMI payment. Penalties for missed payments add up as debt and hit your CIBIL score badly. This way, your loan chances might become costlier with a bad credit score in the future. Ensure regular payment habits and see that your way towards freedom will not only be swifter but much safer as well.

Paying Loan Amount Through Tax Refund

Instead of spending your tax refunds on non-essential items, consider using that money to make prepayments on your loan. This strategy can help you save a significant amount of interest, just like the prepayment example above. Every extra bit of money you can invest into your loan repayment reduces your debt burden and speeds up your financial freedom.

Rent Out Extra Space for Extra Income**

If you have some spare space in your home, consider renting it out. This could be a spare room or an entire floor. You will be earning additional income that can be used to service your loan quicker. This approach will not only help you in servicing EMI but also build a passive source of income.

The Emotional Burden of Debt

It’s more than a financial burden; it’s also an emotional burden. The longer the stretch of your loan, the heavier it is on your shoulders. But following these eight simple steps can take control of your finances and free you from debt sooner. The sooner you pay off the loan, the sooner you are going to be enjoying true financial peace and freedom.

Take action today and start applying these strategies to your loan repayment process. The faster you act, the quicker you’ll reach your goal of a debt-free life.

Pingback: 5 Powerful Factor That Boost Printer Speed for Faster Result

Pingback: IRCTC Sign Up: Create New Account in 5 Easy Steps 2025 Guid